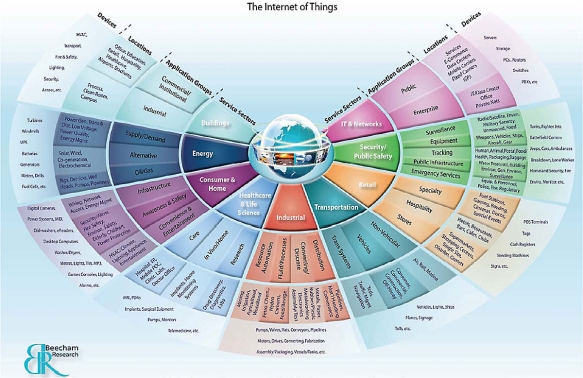

I already spend too much time on the web so what’s it going to be like in 2025 when another 26Bn smart devices are connected to the web?

The recent, excellent, research by Pew looking like at digital life in 2025 gives some pointers to what life might be like once all these smart devices come on-stream. The Pew report reflects that this is a market in the very earliest stages of its evolution with little overall consensus and concerns being expressed around the social (privacy, exclusion) as well as technical implications of IoT (integration). One word however that pops up frequently in the Pew report is “invisible”. The Internet of Things will be notable for being invisible.

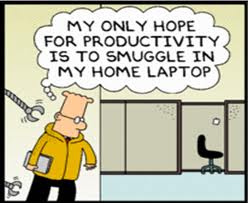

As humans we pretty much mastered our ability to generate data and the emergence of the IoT will take our ability to create data to another dimension. What we haven’t mastered however is our ability to increase time. Human attention is a scarce resource. As a result most of us will be happy to outsource our attention for important yet mundane processes that enable us to focus on more important or enjoyable activities. Health monitoring, driving, service scheduling, insurance renewals, ensuring your finance products are on the best rate of interest, product research and price comparisons, all of these are important yet mundane processes we perform on a daily basis that most for us would be happy to outsource.

Wearables like Google glass and smart watches fail the invisibility test that will be one of the key attributes of successful IoT solutions. Wearables draw users further into the web rather than freeing users from it. Having milk bottles, toothbrushes or trainers sending you alerts and competing for your attention is just ludicrous.

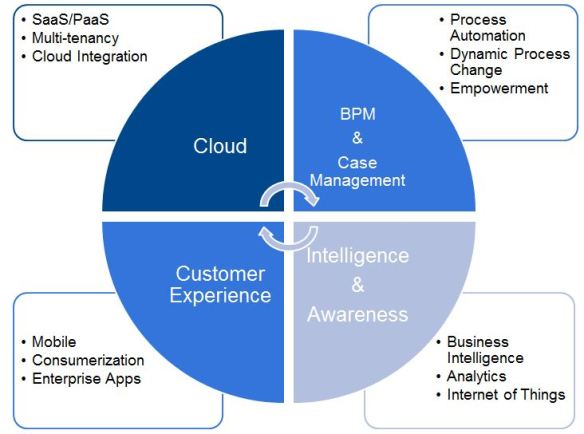

The IoT will act as an airbag for our lives, ready to step in when you need it, not constantly competing for our attention. By freeing us from the mundane activities that today we would have to do manually on the web we are being freed from the internet itself. IoT solutions will make us less dependent on our current web interfaces. We will use the screen and keyboard interface to the web less and less as voice and gesture become more a more appropriate method of interacting with IoT devices. BPM and workflow technologies will orchestrate automatic processes triggered by smart devices, freeing users from mundane processes, interrupting our daily lives only when a decision is required.

Initial successful IoT solutions for example smart meters, inventory management, insurance telematics are for the most part invisible to users and eliminate mundane yet important processes. With IoT the internet will become more and more a part of our daily lives but less and less obtrusive, wrapped around us ready to assist rather than competing for our attention.